Member Login |

Don'ts of Hotel Mobile Marketing & Distribution:

publication date: Aug 27, 2012

|

author/source: Max Starkov

Hotel Mobile Marketing & Distribution Do’s and Don’ts | By Max Starkov

|

|

Hotel Mobile Marketing & Distribution Do’s and Don’ts | By Max Starkov

|

The results of the survey also identify a positive trend: fewer hoteliers (11% in 2012 vs. 38.4% in 2011) did not plan any mobile marketing initiatives this year.

In 2012, based on the property's concrete feeder markets and key customer segments, hotels should be spending at least 10% of their overall digital marketing budgets on mobile marketing initiatives, including on optimization and upgrades to the mobile website, mobile SEO and SEM, mobile display advertising, SMT text marketing initiatives, etc. In 2013, hotels should allocate up to 15% of their overall digital marketing budgets for mobile marketing initiatives.

2. Focus on the Hotel's Mobile Website

The question of whether a hotel or a travel supplier needs a mobile website has already been categorically answered: mobile sites generate serious incremental bookings. The mobile web adheres to different rules than the conventional desktop Internet. Mobile users have even shorter attention spans and less time to browse than traditional desktop users. The mobile web features a number of limiting factors, such as slower speeds, yet-to-be-perfected mobile browsers, smaller displays, multi-step booking and more.

The biggest mistake hoteliers make is not having a mobile site at all. Today's hyperactive travel consumers rely on mobile sites that download quickly, provide short and concise textual content, minimalistic visual content and easy-to-use booking engines.

In June of 2012, more than 85% of desktop Internet users had a screen resolution of 1280×1024 pixels or higher. Trying to squeeze your wide-screen "desktop" hotel website onto the tiny screen of a mobile device is a futile exercise that inevitably destroys usability and conversion rates. Our analysis shows that more than 90% of mobile users access the hotel website via mobile devices with screen sizes of maximum 320 pixels wide by 480 pixels high. Accessing a "conventional" website via a mobile device, even the iPhone (320 x 480 pixels), often results in an undesirable user experience (the inability to find information needed), and a predictable outcome (abandoned websites and reservations).

To solve this issue, hoteliers should offer a mobile website specially designed to provide an excellent user experience in a mobile environment. At the very least, the mobile website should offer the following capabilities/functionality:

- Navigation: Easy-to-use navigation, optimized for an optimum mobile user experience

- Content: A minimum of 10-15 pages of unique and engaging content that is relevant to people on-the-go and addresses the hotel's main customer segments and attributes of the hotel product

- Content Management System (CMS): The mobile site's CMS should be part of and synchronized with the hotel desktop website CMS and the hotel tablet website CMS. The CMS should be able to simultaneously "push" all of the latest special offers, packages and promotions, as well as events and happenings at the property and the destination, to the hotel's desktop, mobile and tablet websites

- Booking Capability: Mobile-enabled booking engine with real-time feed of specials, packages, promotions

- SEO: Website optimized specifically for mobile SEO

- Location Aware/GPS capabilities: Deliver relevant information based on the user's GPS location

- Interactive Capabilities: Real-time event calendar, mapping and directions, interactive contests, sweepstakes, SMS Marketing, real-time customer service, to name a few

- Mobile Web Analytics: Track performance and conversions from the mobile website

Content quality is the biggest "must-have" for a mobile site. The Google Panda algorithm updates favor mobile websites with richer visual and textual content that is not only deep and relevant but also fresh, engaging and optimized for the search engines.

There is a growing need for a centralized digital content depository as hotel marketers are challenged to create and manage content through three distinct channels: desktop, mobile and tablet. HeBS Digital's proprietary CMS Premium acts as a centralized digital library that services all three channels by pushing content to the property's desktop, tablet and mobile websites simultaneously, as well to the property's social media profiles on Facebook and Twitter.

3. Engage in Hotel Mobile Marketing

Having a hotel mobile website – even if developed according to industry's best practices – is only the beginning. Just like with the mobile website, the mobile Web abides by different rules that require mobile Web-specific marketing initiatives.

Here are the top mobile marketing initiatives hoteliers should focus on in 2012 and beyond:

- Mobile SEO

- Mobile link building to the mobile site from mobile directories and sites

- Mobile SEM (paid search) campaigns

- Local Content Optimization: mobile search engines favor and predominantly serve local content, therefore hoteliers need to optimize their local content and listings on the search engines, main data providers, local business directories, yellow pages, etc.

- Mobile banner advertising in main mobile feeder markets

- Engage your customers via mobile contests and sweepstakes

- Mobile promotions via SMS for local property deals to:

- Generate buzz

- Grow mobile list

- Target customer segments

- Integrate with Social Media

Mobile marketing should be an integral part of the hotel's multi-channel marketing strategy. Its role has been growing exponentially over the past years and will explode over the next few years.

Any seasonal promotion (summer getaways, holiday specials, etc.) or customer segment campaign (e.g. family travel, leisure, weekend, etc.) should contain a mobile marketing component to reach the on-the-go travel consumer and drive-in markets.

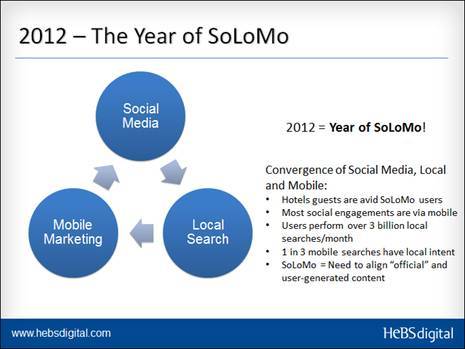

4. Take Advantage of SoLoMo

This year, hoteliers have been hearing a lot of the buzzword SoLoMo (SOcial, LOcal, MObile). Meant to convey the convergence of these three major media, the term SoLoMo describes a "marriage made in heaven" between the three content and marketing platforms.

Why should hoteliers bring social, local and mobile marketing initiatives to the forefront of their hotel digital marketing plans this year? Hotel guests are avid SoLoMo services users. Most social network engagements by travel consumers are done via mobile devices. Consumers perform more than 3 billion local searches every month, and one in three mobile searches have local intent vs. one in five desktop searches [Google].

Unlike the desktop Web world, SoLoMo allows hoteliers to combine real-time customer geo-location with their demographic and psychographic information and time- and location-relevant promotions. Hoteliers need to consider how to best utilize SoLoMo to engage their guests and generate incremental revenues.

By focusing efforts on social media, local marketing, and mobile marketing, hotel marketers have the ability to deliver more personalized, relevant content and engage existing guests and potential customers like never before.

|

Hotel Mobile Marketing & Distribution Do’s and Don’ts | By Max Starkov

|

It is important to understand that local content means mobile content. Google has amassed the most detailed library of local content via its Google+ Local (formerly Google Places) and Google Maps. How optimized are your property profiles in the main data providers – such as Localeze – which feed many local directories and geo-social sites? How optimized are your property local search listings on Google+ Local, Yahoo Local, and Bing Local? What about all the local online business directories and yellow pages? Do you have a local citation listing program in place?

One of the best examples of SoLoMo is the recent move by Google to "marry" its local content listings (Google Places) with its social network (Google+) and making this content the default in its mobile search results. By converting more than 80 million Google Places listings to Google+ Local pages, Google achieved an unprecedented level of dynamic, social content vs. static directory content. For example, Google+ Local includes integration of a circles filter to find reviews or recommendations from friends/family/colleagues.

Once you take care of your local content, it is time to enhance your mobile marketing presence. How deep, relevant and engaging is the local content on your mobile site? Do you have automated push of specials, promotions and local events from the property "desktop" website to the mobile site to keep your mobile presence "fresh?" Do you use micro-formats and Schema codes to relay the time- and location-relevant nature of these promotions and events to the search engines? Does your property take advantage of coupon promotions through Google?

Other recommendations include engaging your local customers via time- and location-relevant check-in promotions and rewards, launching social media promotions, contests, and post series via Facebook and Twitter, and blogging. Geo-social marketing initiatives allow hoteliers to integrate with consumers' lifestyles and connect (and stay connected) with them in ways that were not previously possible. Social, local and mobile marketing are great for time- and location-sensitive promotions.

5. Align the Official and Unofficial Content About the Hotel

A very important consequence of the convergence of social, local and mobile is the fact that today's SoLoMo-enabled travel consumers have immediate 24/7 access to all types of content about your hotel: the "official" content about the hotel e.g. hotel website, Facebook pages, Google+ Local descriptions, etc. and the "unofficial" user-generated content on the social networks and customer review sites. This convergence of local content, social media and mobile allows potential customers to quickly check reviews on sites like TripAdvisor or Yelp, see the Google+ Local listing of the hotel with all of its user-generated content and reviews, and/or communicate with friends via Facebook or Twitter about their experiences at the hotel.

Now, more than ever, you need to align the official and unofficial content about your hotel. Example: You cannot claim your property offers luxury accommodations if reviewers on TripAdvisor or Google's Zagat Reviews describe your rooms as suited for the budget traveler at best.

The bigger the discrepancy between the two types of content, the less credible the official content is since people trust user-generated content more. Avoiding major discrepancies between these two kinds of content leads to higher website conversion rates and more mobile bookings.

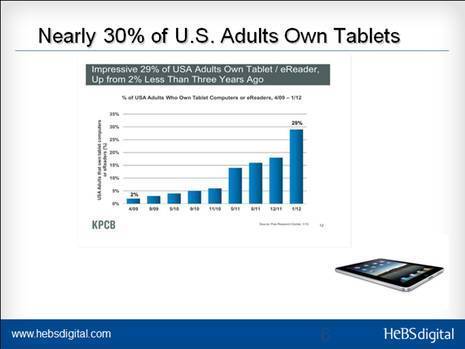

6. Consider a Major Push in the Tablet Channel

Tablets are rapidly emerging as a separate device/channel category from desktop and mobile. According to eMarketer, global tablet sales are projected to exceed 232 million in 2016, growing from 64 million in 2011. Next year, there will be 75.6 million U.S. tablet users vs. just 13 million in 2010.

Search engines and many major media sites already consider tablets as a separate, distinct device category, characterized with its own unique user behavior and best practices for user experience and content delivery.

For all practical purposes, the desktop, mobile device and tablet address different needs at different times of the day and week. According to Google, users searching Google utilize:

- Desktop during the day (office)

- Mobile during lunch break + happy hour

- Tablet later in the evening when lounging i.e. the tablet is a "lounging" device

According to Google's company data, 7% of all searches already come from tablets vs. 14% from mobile devices and 79% via desktops (Q1, 2012). Google also reports different search dynamics across the three device/channel categories and a dramatic increase in hotel queries in the mobile and tablet channels on Google in Q1 2012:

- Overall (desktop + mobile + tablet): +34%

- Mobile devices: +120%

- Tablet devices: +306%

Hotel and travel marketers should consider either enhancing their desktop website for the touch-screen tablet environment or build a tablet-only version of their website, in addition to their desktop and mobile sites, all managed via a single digital content depository-enabled CMS.

|

Hotel Mobile Marketing & Distribution Do’s and Don’ts | By Max Starkov

|

7. Improve the Mobile Booking Process

Many reservation technology vendors do not have mobile-friendly versions of their booking engines. The three main issues as far as usability in the mobile booking process are:

- Mobile-enabled booking engine: You cannot use your desktop booking engine on your mobile website or app. Employ a simplified booking engine with step-by-step processes, touch-screen interfaces, easy drop-down menus, shorter product descriptions, thumb-nail images, etc.

- Real-time feed of specials, packages and promotions: Your mobile booking engine should feature all of the hotel's or travel supplier's special offers, packages and promotions.

- Mobile-friendly payment system for the travel or hotel booking: The booking process on your mobile website or app has to allow for simplified reservations without the need to enter a credit card. This could be done by entering and storing the credit card information in advance via the "desktop" website. Since the mobile channel is a last-minute booking channel, another approach is accepting mobile reservations and holding for a set number of hours (e.g. 4, 6 or 8 hours), or taking "no guarantee" reservations.

8. Use Mobile Analytics

The explosion of social media and mobile marketing, along with channel convergence and multi-channel marketing, has made it imperative for hoteliers to track the effectiveness of hotel digital marketing initiatives and optimize returns from their limited budget resources. The available analytical technology tools today offer cost-effective yet powerful ways to track results.

In the mobile channel, this technology allows us to track conversions from the hotel website and all digital advertising campaigns such as SEM, banner advertising and re-targeting. In addition, call analytics allows us to track the effectiveness of the voice channel, as well as the mobile Web and print ads.

- Mobile Website Analytics: Using analytics on the mobile site is a MUST! Hoteliers may use a free tool like Google Analytics, or a more sophisticated and accurate analytical tool like Adobe® SiteCatalyst® . At minimum, hoteliers need to track:

- Originating/referring channel (e.g. SEO vs. SEM)

- Bookings, room nights, revenue, conversation rates

- Visitors, pageviews, mobile devices vs. tablets, etc.

- Mobile Call Analytics: Best practices require the use of a call-analytics enabled reservation telephone number or at least a dedicated 1-800 number on the mobile site. Remember, 6-7 of 10 reservations originating from the mobile site still come in the form of calls via the user's cell phone.

- Mobile Marketing Campaign Tracking: Hoteliers need to use campaign tracking analytics for all mobile campaigns. Track your SEM campaigns with Adobe or Google Analytics. For your mobile banner campaigns, use Adobe, DART, ATLAS, etc.

Don'ts of Hotel Mobile Marketing & Distribution:

1. Don't Discount in the Mobile Channel

All travel suppliers – hotels, airlines, car rental companies, cruise lines, etc. – manage perishable inventory, so theoretically you would expect that these suppliers would be launching last-minute promotions to unload at least part of their unsold inventory. Wrong! In the case of the airlines, the closer to the date of departure, the higher the airfare – not the other way around.

The most common mistake by hoteliers we are witnessing today is the urge to discount in the mobile channel. My advice is not to discount in the mobile channel!

The mobile channel is a last-minute distribution channel by default. In this hyper-connected social and mobile world, the booking window has shrunk tremendously over the past few years and travel consumers have embraced the mobile Web as a legitimate booking channel:

- Typically, mobile bookings are for the next 48 hours [Google].

- As already mentioned, many major hotel brands report that 65%-80% or more of their mobile bookings are for the same or the following day.

In other words, the mobile channel is a last-minute distribution channel by default. If hoteliers take all of the recommended action steps outlined in this article, these bookings would happen anyway without discounts. Hoteliers need to maintain rate parity at all times.

Since people are booking closer and closer to the day of their arrival, it is easier for them to wait and see what the last-minute rates are on the hotel's mobile site, on an OTA site or on a last-minute discount site such as HotelTonight.com, as opposed to booking in advance via the hotel desktop or mobile sites.

In the age of social and mobile word of mouth, it will not take long for all regular and frequent guests at your hotel to hear about the lower last-minute rates offered via an OTA or a service like HotelTonight.com. What will be the result? The hotel will soon see that:

- Booked guests are canceling existing reservations made via the hotel website, phone, GDS, and OTAs, and re-booking via HotelTonight.com using the lower rates.

- Potential guests are waiting until the last minute to see what the last-minute rates are for the property and other hotels in the city/location they are traveling to and booking at the last minute.

- OTAs are after the hotel for these last-minute deviations from contracted rate parity clauses.

If hoteliers do all of the 'Mobile Marketing Do's' recommended above, these bookings would happen anyway without discounting.

- Avoid the temptation to discount! Don't discount via mobile discounters, OTAs and Flash Sales Sites.

- Invest in your mobile website and mobile marketing to boost last-minute reservations.

- Market your true best available rates last-minute.

- Maintain rate parity and brand integrity at all times.

In the case of group cancellations or occupancy needs, launch a special promotion on the hotel website, send out an email spotlight promotion to the opt-in list, launch a paid search campaign on Google and Yahoo/Bing, as well as desktop and mobile banner campaigns via the Google Display Network, or do a SMT text marketing push promotion. If this is not sufficient, for additional same-day bookings and last-minute sales, use opaque sites such as Priceline and HotWire, which are preferable to flash sale sites as they maintain brand integrity until the booking is completed.

2. You Don't Need a Mobile App

Here at HeBS Digital, we are constantly being asked by our hotel clients whether it makes sense for a hotel to develop its own mobile app or if the hotel should focus on developing and enhancing their mobile website. From the survey results table above, we can see the number of hoteliers planning for an iPhone app dropped dramatically: from 24.1% in 2010 to 8.9% in 2011.

I believe that hotels do not need a mobile app if they are a single-property, independent hotel. Nor do franchised hotels and resorts or smaller and mid-size hotel chains and multi-property companies. These hotel companies are better off focusing on building and enhancing their mobile websites and promoting the mobile site via mobile marketing initiatives.

A 2011 study by CEM4Mobile Analytics, which used an actual sample of over 56 million mobile impressions from mobile services supporting both applications and browsing-based access, concluded that the vast majority of users (90.15%) prefer mobile browsing vs. mobile apps:

|

Hotel Mobile Marketing & Distribution Do’s and Don’ts | By Max Starkov

|

Another survey by Adobe and eMarketer found that users prefer a mobile app only in the following three categories: social networking, music and games. For everything else they prefer to browse (i.e. search for mobile websites). In every other category that pertains to travel research, planning and purchasing, mobile users prefer to browse or search relevant mobile website content. Eighty-one percent of users preferred browsing when researching products/services and price; 71% favored browsing when comparing products and services, and 68% used browsing when reading customer reviews.

There are several other reasons why hoteliers should focus on a mobile website as opposed to building a mobile app:

- Apps are very expensive to build, maintain, and promote.

- Apps are device specific – you need different apps for iPhone, Android, Windows Mobile, etc.

- Apps are not indexable by the search engines.

Consider seeking advice from a leading mobile marketing and full-service hotel digital marketing firm to actively help you take advantage of the mobile channel one step at a time. Learn which mobile marketing formats make the most sense for your hotel and how to implement latest trends and best practices in your mobile marketing efforts so you can realize respectable ROI and incremental revenue growth.

Max Starkov is President & CEO of HeBS Digital, the hospitality industry's leading full-service digital marketing and direct online channel strategy firm based in New York City (www.HeBSdigital.com). Erica Garza, Senior Copy+SEO Specialist at HeBS Digital, also contributed to this article.

HeBS Digital has pioneered many of the best practices in hotel digital marketing, social and mobile marketing, and direct online channel distribution. The firm has won over 200 prestigious industry awards for its digital marketing and website design services, including numerous Adrian Awards, Davey Awards, W3 Awards, WebAwards, Magellan Awards, Summit International Awards, Interactive Media Awards, IAC Awards, etc.

A diverse client portfolio of top-tier major hotel brands, luxury and boutique hotel brands, resorts and casinos, hotel management companies, franchisees and independents, and CVBs are benefiting from HeBS Digital's direct online channel strategy and digital marketing expertise. Contact HeBS Digital's consultants at (212) 752-8186 or success@hebsdigital.com.

CLICK HERE to learn more about HeBS Digital (Hospitality eBusiness Strategies)

c

Email: max@hebsdigital.com

HeBS Digital (Hospitality eBusiness Strategies)

www.HeBSdigital.com

1601 Broadway, 11th Floor

USA - New York, NY 10019

Phone: 212-752-8186

Fax: 212-202-3670

Email: info@hebsdigital.com